FINANCIAL BUDGET PLANNER HOW TO

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs. A successful budget planner helps you decide how to best spend your money while avoiding or reducing debt.

These ads are based on your specific account relationships with us. While the RBA’s main tool for influencing economic activity is interest rates, the government’s main tools are government spending and taxes. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you sign in to your account, for example through Online Banking or MyMerrill. If you opt out, though, you may still receive generic advertising.

If you prefer that we do not use this information, you may opt out of online behavioral advertising.

FINANCIAL BUDGET PLANNER OFFLINE

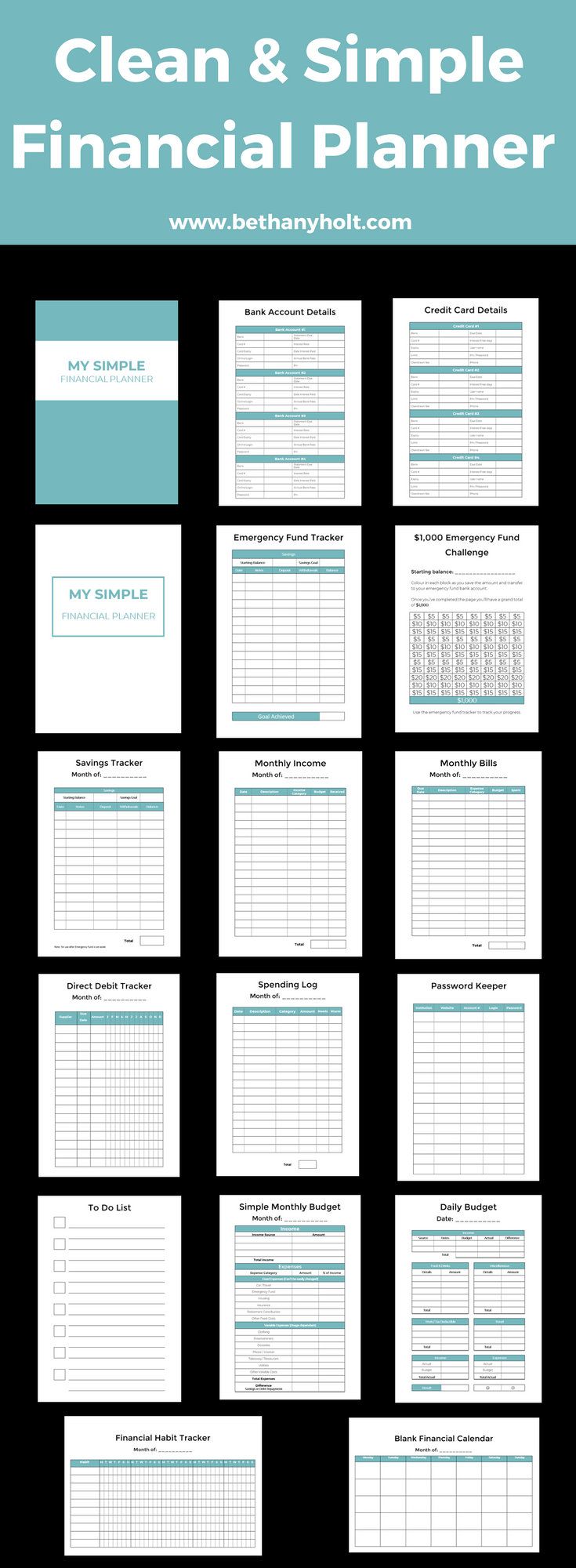

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Organize your budget, save money & reach your financial goals with a best-selling budget planner, budget journal & accessories.

It allows you to track your expenses, set financial goals, and make informed choices about how to use your money. Relationship-based ads and online behavioral advertising help us do that. Creating a budget is the key to successful budget management and expansions. We strive to provide you with information about products and services you might find interesting and useful. Mint lets you track and manage your income and spending, budgets, savings goals, and investments.

0 kommentar(er)

0 kommentar(er)